California Dept Of Tax And Fee Administration: Your Ultimate Guide

Listen up, folks. The California Dept of Tax and Fee Administration, or CDTFA for short, is no joke. It's like the bouncer at a super exclusive club—making sure everyone pays their dues before they can party. But don’t get me wrong, this isn’t about scaring you off. It’s about understanding how the system works so you can stay on top of your financial game. Whether you’re a small business owner, an entrepreneur, or just someone trying to navigate the world of taxes, the CDTFA plays a massive role in shaping how money flows in California.

Now, I know what you’re thinking: “Taxes? Really? That sounds as thrilling as watching paint dry.” But hear me out. This isn’t just about filling out forms or stressing over April 15th deadlines. The CDTFA handles more than just income tax. They deal with sales tax, excise tax, fuel tax, and even cannabis tax. Yup, you read that right—cannabis tax. California’s got a booming legal weed industry, and the CDTFA makes sure all those green dollars (pun intended) are accounted for.

So, buckle up because we’re diving deep into the world of the California Dept of Tax and Fee Administration. By the end of this, you’ll know exactly what they do, why they matter, and how you can avoid any unnecessary headaches. Ready? Let’s go.

- Lululemon Discount For First Responders Your Ultimate Guide

- Elhurst The Hidden Gem Youve Been Missing In Your Bucket List

Table of Contents

- What is the California Dept of Tax and Fee Administration?

- A Quick History of the CDTFA

- Key Functions and Responsibilities

- Sales Tax: The Big Kahuna

- Cannabis Tax: Green Money, Big Business

- How Does the CDTFA Work?

- Resources for Taxpayers

- Staying Compliant: Tips and Tricks

- Common Questions About the CDTFA

- Wrapping It Up

What is the California Dept of Tax and Fee Administration?

The California Dept of Tax and Fee Administration, or CDTFA, is basically the tax police of California. They’re the folks who make sure businesses and individuals are paying their fair share of taxes. Think of them as the financial watchdogs of the Golden State. And trust me, they’ve got a lot on their plate.

Here’s the deal: The CDTFA was born out of a merger between the Board of Equalization and the Alcoholic Beverage Control. This happened back in 2017, and since then, they’ve been handling everything from sales tax to cigarette tax. Yeah, that’s right—cigarettes too. If you’re selling anything taxable in California, chances are the CDTFA is keeping an eye on you.

Why Does the CDTFA Matter?

Let’s break it down. The CDTFA matters because it directly impacts your wallet. If you’re a business owner, they determine how much tax you owe on your sales. If you’re a regular Joe or Jane, they affect the prices you pay at the register. And if you’re in the cannabis game, well, they’re basically your financial partner-in-crime.

- Why The Beamer Bmw Is The Ultimate Driving Machine For Enthusiasts

- Justin Jefferson Girlfriend The Untold Story Of Love And Fame

A Quick History of the CDTFA

Alright, let’s rewind for a sec. The CDTFA wasn’t always around. Before 2017, the Board of Equalization (BOE) was the big player in the California tax scene. But then, the state decided to shake things up. In 2017, they merged the BOE with the Alcoholic Beverage Control to create the CDTFA. The idea was to streamline operations and make things more efficient.

And guess what? It worked. The CDTFA is now a powerhouse when it comes to tax collection. They’ve modernized systems, improved customer service, and even rolled out some pretty slick online tools. It’s like they went from using a rotary phone to an iPhone overnight.

Key Functions and Responsibilities

So, what exactly does the CDTFA do? Let me break it down for you:

- Sales Tax Collection: They handle all the sales tax stuff. From retailers to online sellers, they make sure everyone’s paying up.

- Excise Tax: This includes taxes on things like cigarettes, diesel fuel, and alcohol. If it’s got a special tax, the CDTFA’s got it covered.

- Cannabis Tax: With California’s booming cannabis industry, the CDTFA plays a huge role in regulating and taxing this green gold.

- Fee Administration: They manage fees for things like alcohol licenses and other regulatory permits.

Basically, if it involves money and the state of California, the CDTFA is probably involved somehow.

Sales Tax: The Big Kahuna

When it comes to the CDTFA, sales tax is king. It’s the biggest chunk of their operations, and it affects pretty much everyone in California. Whether you’re buying a coffee at Starbucks or a car from Tesla, sales tax is part of the deal.

Here’s the kicker: California’s sales tax rates can vary depending on where you are. Some cities have higher rates than others. For example, Los Angeles has a sales tax rate of around 9.5%, while San Francisco clocks in at about 9%. Confusing, right? That’s why the CDTFA provides tools and resources to help businesses and consumers navigate these differences.

How Sales Tax Works

Sales tax works like this: when you buy something, the retailer collects the tax and sends it to the CDTFA. Simple, right? Well, not always. There are exemptions, different rates for different products, and all sorts of nuances that can make things tricky. But fear not! The CDTFA has got your back with guides and FAQs to help you figure it all out.

Cannabis Tax: Green Money, Big Business

Now, let’s talk about the elephant in the room—cannabis. California legalized recreational marijuana back in 2016, and since then, it’s been a goldmine for the state. And guess who’s collecting all those sweet tax dollars? You guessed it—the CDTFA.

The cannabis tax structure in California is a bit complex. There’s the cultivation tax, the excise tax, and even local taxes to consider. But the CDTFA has done a pretty good job of making it all work. They’ve created a system that ensures both consumers and businesses are paying their fair share while still promoting a safe and regulated market.

Why Cannabis Tax Matters

Cannabis tax matters because it’s a major revenue stream for California. In fact, the state raked in over $1 billion in cannabis tax revenue in 2022 alone. That money goes towards things like education, healthcare, and public safety. So, the next time you buy a joint, remember—you’re helping fund some pretty important stuff.

How Does the CDTFA Work?

Alright, let’s get into the nitty-gritty of how the CDTFA operates. At its core, the CDTFA is all about enforcement and compliance. They’ve got auditors, investigators, and even a team of data analysts working behind the scenes to make sure everything runs smoothly.

Here’s how it works: businesses register with the CDTFA, file their tax returns, and pay their taxes. If they don’t comply, the CDTFA steps in to investigate. And trust me, you don’t want to mess with these guys. They’ve got the power to impose penalties, interest, and even legal action if necessary.

Technology and Innovation

One thing the CDTFA does really well is embrace technology. They’ve rolled out online portals, mobile apps, and even chatbots to help taxpayers stay on top of things. It’s like they’re saying, “Hey, we know life’s busy. Let us make it easier for you.” And honestly, who can argue with that?

Resources for Taxpayers

The CDTFA offers a ton of resources to help taxpayers navigate the world of taxes. From guides and FAQs to webinars and workshops, they’ve got you covered. Here are a few of my favorites:

- Online Taxpayer Account: Manage your taxes, view statements, and make payments all in one place.

- CDTFA Learning Center: A treasure trove of information on everything from sales tax to cannabis tax.

- Customer Service: Need help? The CDTFA’s got a team of experts ready to assist you.

So, whether you’re a first-time taxpayer or a seasoned pro, the CDTFA’s got the tools you need to succeed.

Staying Compliant: Tips and Tricks

Compliance is key when it comes to dealing with the CDTFA. Here are a few tips to help you stay on their good side:

- File on Time: Late filings can lead to penalties and interest. Set reminders, use the online portal, and stay organized.

- Know Your Rates: Make sure you’re aware of the sales tax rates in your area. It can vary from city to city.

- Seek Help: If you’re unsure about something, don’t hesitate to reach out to the CDTFA or consult with a tax professional.

Remember, the CDTFA isn’t out to get you. They’re just doing their job. So, play nice, stay compliant, and you’ll be golden.

Common Questions About the CDTFA

Got questions? We’ve got answers. Here are some of the most common questions people ask about the CDTFA:

- What happens if I don’t pay my taxes? Penalties and interest, my friend. And potentially legal action if it gets serious.

- Can I appeal a tax decision? Absolutely. The CDTFA has a process for appeals if you feel a decision was unfair.

- How do I register my business with the CDTFA? Head to their website and follow the steps. It’s pretty straightforward.

Still unsure? The CDTFA’s got a whole team of experts ready to help you out.

Wrapping It Up

Alright, folks, that’s the lowdown on the California Dept of Tax and Fee Administration. Whether you’re a small business owner, a cannabis entrepreneur, or just someone trying to make sense of all the tax jargon, the CDTFA plays a crucial role in your financial life.

So, here’s what you need to remember: stay informed, stay compliant, and take advantage of the resources the CDTFA offers. And if you ever find yourself scratching your head, don’t hesitate to reach out for help. After all, the CDTFA’s job is to make sure everyone’s paying their fair share—and doing it right.

Got thoughts? Questions? Drop a comment below or share this article with your friends. Let’s keep the conversation going. Because when it comes to taxes, knowledge is power—and power is everything.

- Erin E Surance The Ultimate Guide To Understanding Insurance Like A Pro

- Dolphin Bell Incident The Untold Story Of An Underwater Mystery

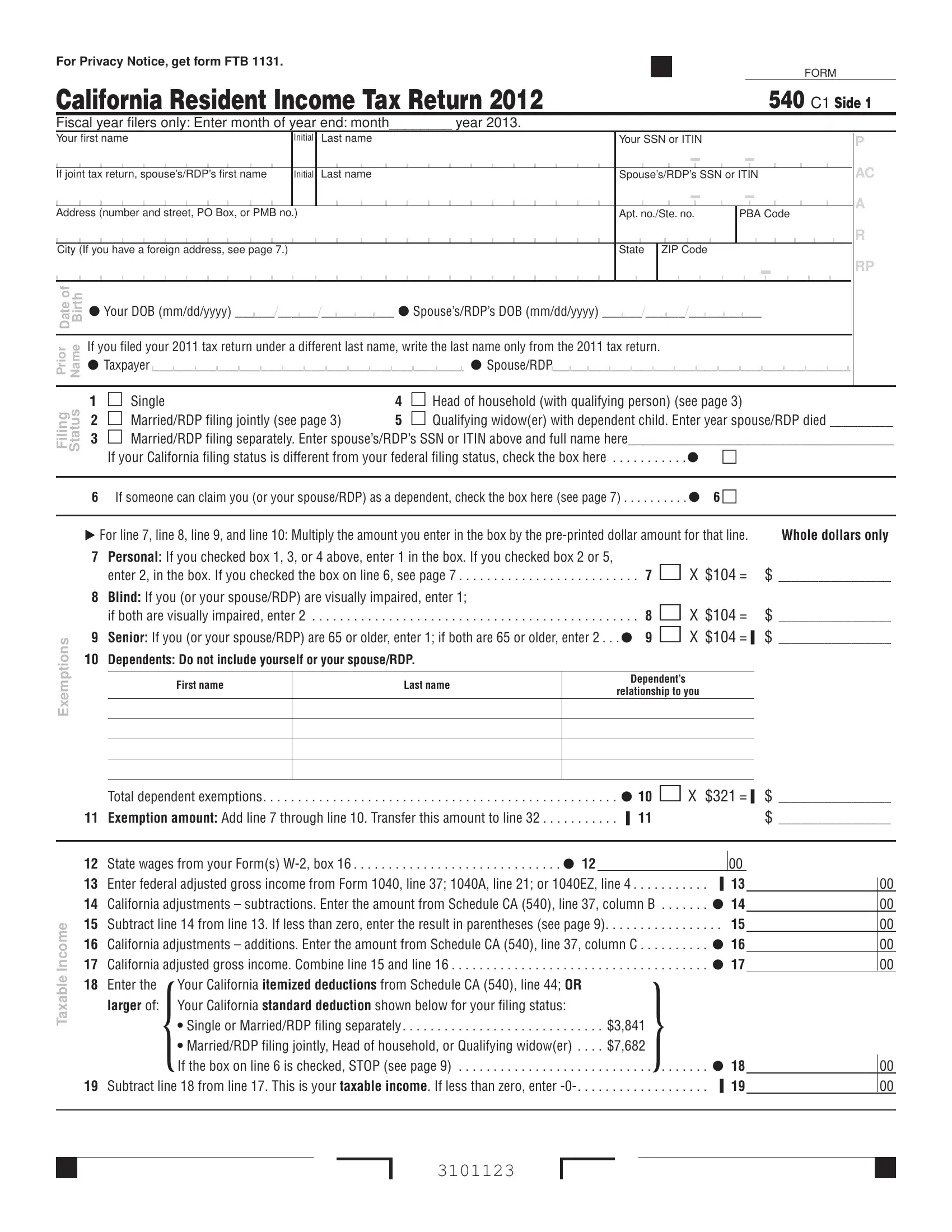

Form 540 Es California

About

What Are the California Department of Tax and Fee Administration and