Chase Bank Money Conversion: The Ultimate Guide You've Been Waiting For

Ever wondered how Chase Bank handles money conversion? Well, buckle up because we're diving deep into the world of currency exchange, fees, and everything else you need to know about Chase Bank's money conversion services. Whether you're planning an international trip, sending money overseas, or just curious about how this works, you're in the right place. Let's break it down step by step so you don't get lost in the financial jargon.

Chase Bank money conversion is a service that many people overlook until they're stuck in a situation where they need it most. Imagine being in Paris or Tokyo and realizing your dollars aren't exactly welcome everywhere. That's where Chase steps in, offering solutions to convert your cash without breaking the bank. But is it as good as it sounds? Let's find out.

Before we jump into the nitty-gritty, let's clear the air. This isn't just another article filled with fluff. We're going to cover everything from the basics to advanced tips, ensuring you're equipped with the knowledge to make smart financial decisions. So, grab your favorite drink, and let's get started!

- Who Was Bard In The Hobbit The Unlikely Hero Of Laketown

- Jennifers Husband The Untold Story Behind The Spotlight

Table of Contents

- What is Chase Bank Money Conversion?

- How Does Money Conversion Work at Chase?

- Fees Associated with Chase Bank Money Conversion

- Exchange Rates at Chase Bank

- Using Chase for International Transfers

- Alternatives to Chase Bank Money Conversion

- Tips for Saving on Money Conversion

- Common Questions About Chase Money Conversion

- Benefits of Using Chase for Money Conversion

- Final Thoughts

What is Chase Bank Money Conversion?

Let's start with the basics. Chase Bank money conversion refers to the process of exchanging one currency for another through Chase's banking services. Whether you're traveling abroad or dealing with international transactions, Chase offers tools to help you manage different currencies efficiently. It's not just about swapping dollars for euros; it's about ensuring you get the best deal possible.

Chase Bank has been in the game for a while, and their money conversion services are designed to cater to both individuals and businesses. From everyday travelers to multinational corporations, Chase provides tailored solutions to meet diverse needs. But how exactly does it work?

Well, the process is pretty straightforward. You initiate a conversion request either online or at a branch, specify the amount and currency you want, and Chase handles the rest. Easy peasy, right? Not so fast. There's more to it than meets the eye, and we'll explore that in the next section.

- Get Ready For The Ultimate Adventure La County Fair Tickets 2024

- Taylor Swifts Seashore Album A Dive Into Her Latest Masterpiece

How Does Money Conversion Work at Chase?

Now that we've got the basics down, let's dive into the mechanics of Chase Bank money conversion. When you request a currency exchange, Chase uses the current exchange rate to determine how much of the foreign currency you'll receive. But here's the kicker: there's usually a markup involved. This means the rate you see might not be the exact rate you get.

Chase also offers different methods for money conversion, including:

- ATM withdrawals in foreign currencies

- Wire transfers for international payments

- In-person exchanges at branches

- Online currency exchange through your Chase account

Each method comes with its own set of pros and cons, so it's essential to choose the one that best fits your needs. For example, if you're traveling, using your Chase debit card at ATMs might be more convenient than carrying cash. On the other hand, if you're making a large international transfer, a wire transfer might be the way to go.

Step-by-Step Process

Here's a quick rundown of how the money conversion process works at Chase:

- Log in to your Chase account or visit a branch

- Select the currency you want to exchange

- Enter the amount you wish to convert

- Review the exchange rate and fees

- Confirm the transaction

Simple, right? Well, almost. There are a few things to keep in mind, especially when it comes to fees and exchange rates. Let's break those down next.

Fees Associated with Chase Bank Money Conversion

No discussion about money conversion is complete without talking about fees. Chase Bank, like most financial institutions, charges fees for currency exchange services. These fees can add up quickly, so it's crucial to understand them before making any transactions.

The most common fees you'll encounter include:

- Markup on exchange rates

- ATM withdrawal fees

- International transaction fees

- Wire transfer fees

Markup on exchange rates is one of the biggest culprits. Chase doesn't explicitly state the markup percentage, but industry standards suggest it could be anywhere from 2% to 5%. This means if you're exchanging $1,000, you could lose up to $50 just in markup fees alone.

How to Minimize Fees

Now, here's the good news: there are ways to minimize these fees. For starters, consider using a Chase debit card with no foreign transaction fees. Some Chase credit cards also offer this benefit, so it's worth checking if you qualify. Additionally, you can opt for online exchanges instead of in-person transactions, as they often come with lower fees.

Another tip? Always review the exchange rate before confirming a transaction. While Chase provides competitive rates, it's always a good idea to compare them with other providers to ensure you're getting the best deal.

Exchange Rates at Chase Bank

Exchange rates are the backbone of any money conversion service, and Chase Bank is no exception. The rates offered by Chase are based on the interbank market rates but are subject to markups, as mentioned earlier. This means the rate you see on financial news outlets might not be the exact rate you get from Chase.

Chase updates its exchange rates regularly to reflect current market conditions. However, the exact timing of these updates can vary, so it's important to check the rates frequently if you're planning a large transaction.

How to Get the Best Exchange Rate

Getting the best exchange rate at Chase Bank involves a bit of strategy. Here are a few tips:

- Monitor exchange rates closely and time your transaction accordingly

- Use Chase's online platform for exchanges, as they often offer better rates

- Consider opening a Chase account with perks like no foreign transaction fees

Remember, even small differences in exchange rates can add up to significant savings over time. So, it pays to be diligent and informed.

Using Chase for International Transfers

International transfers are another area where Chase Bank money conversion shines. Whether you're sending money to family overseas or paying for goods and services in a foreign currency, Chase offers several options to make the process smooth and secure.

One of the most popular methods is wire transfers. Chase allows you to send money internationally through wire transfers, which can be initiated online or at a branch. The process typically involves providing the recipient's bank details, specifying the amount, and selecting the currency.

While wire transfers are reliable, they do come with fees. Chase charges a flat fee for outgoing international wire transfers, which can range from $10 to $40 depending on the method used. Additionally, the recipient's bank may charge an incoming fee, so it's essential to factor that into your calculations.

Tips for International Transfers

Here are a few tips to make your international transfers with Chase more efficient:

- Double-check the recipient's bank details to avoid delays or errors

- Use Chase's online platform for faster processing times

- Consider setting up recurring transfers if you frequently send money overseas

By following these tips, you can ensure your international transfers go smoothly and efficiently.

Alternatives to Chase Bank Money Conversion

While Chase Bank offers solid money conversion services, it's not the only player in the game. There are several alternatives you might want to consider, depending on your specific needs:

- Western Union: Known for its fast and reliable international money transfers

- Revolut: A digital banking platform offering competitive exchange rates and low fees

- PayPal: A popular choice for online transactions and international payments

Each of these alternatives has its own strengths and weaknesses, so it's important to weigh your options carefully. For example, if you prioritize speed, Western Union might be the way to go. If you're looking for low fees, Revolut could be a better fit.

Tips for Saving on Money Conversion

Now that you know the ins and outs of Chase Bank money conversion, let's talk about saving money. Here are some practical tips to help you get the most out of your currency exchanges:

- Shop around for the best exchange rates

- Use a Chase account with no foreign transaction fees

- Avoid exchanging money at airports or hotels, as they often have higher fees

- Consider carrying a mix of cash and cards for international travel

By implementing these strategies, you can significantly reduce the costs associated with money conversion and keep more of your hard-earned cash.

Common Questions About Chase Money Conversion

Let's address some of the most frequently asked questions about Chase Bank money conversion:

Q1: What currencies does Chase offer?

Chase offers a wide range of currencies, including major ones like the euro, pound sterling, and yen. However, availability may vary depending on your location and the method of exchange.

Q2: Are there any limits on money conversion?

Yes, Chase imposes daily and monthly limits on currency exchanges. These limits vary based on your account type and the method of exchange. It's always a good idea to check with Chase for the most up-to-date information.

Q3: Can I cancel a money conversion transaction?

Once a money conversion transaction is confirmed, it cannot be canceled. This is why it's crucial to review all details carefully before proceeding.

Benefits of Using Chase for Money Conversion

So, why should you choose Chase Bank for your money conversion needs? Here are a few compelling reasons:

- Competitive exchange rates

- Secure and reliable transactions

- Convenient online platform

- Wide range of currencies available

Chase Bank has established itself as a trusted name in the financial industry, offering robust services that cater to a variety of customer needs. Whether you're a seasoned traveler or a business owner, Chase has something to offer you.

Final Thoughts

Chase Bank money conversion is a valuable service that can simplify your financial life, especially when dealing with international transactions. By understanding how it works, being aware of fees, and knowing your options, you can make informed decisions that save you time and money.

We hope this guide has provided you with the insights you need to navigate the world of currency exchange with confidence. Remember, knowledge is power, and in the financial world, it can mean the difference between saving and splurging.

So, what are you waiting for? Take action today! Whether it's exploring Chase's services further,

- Pittsburgh Steelers On Siriusxm Your Ultimate Guide To The Steel Citys Beloved Team

- Top Spots For Food Lovers The Best Places To Eat In Owatonna

Options Trading with J.P. Chase

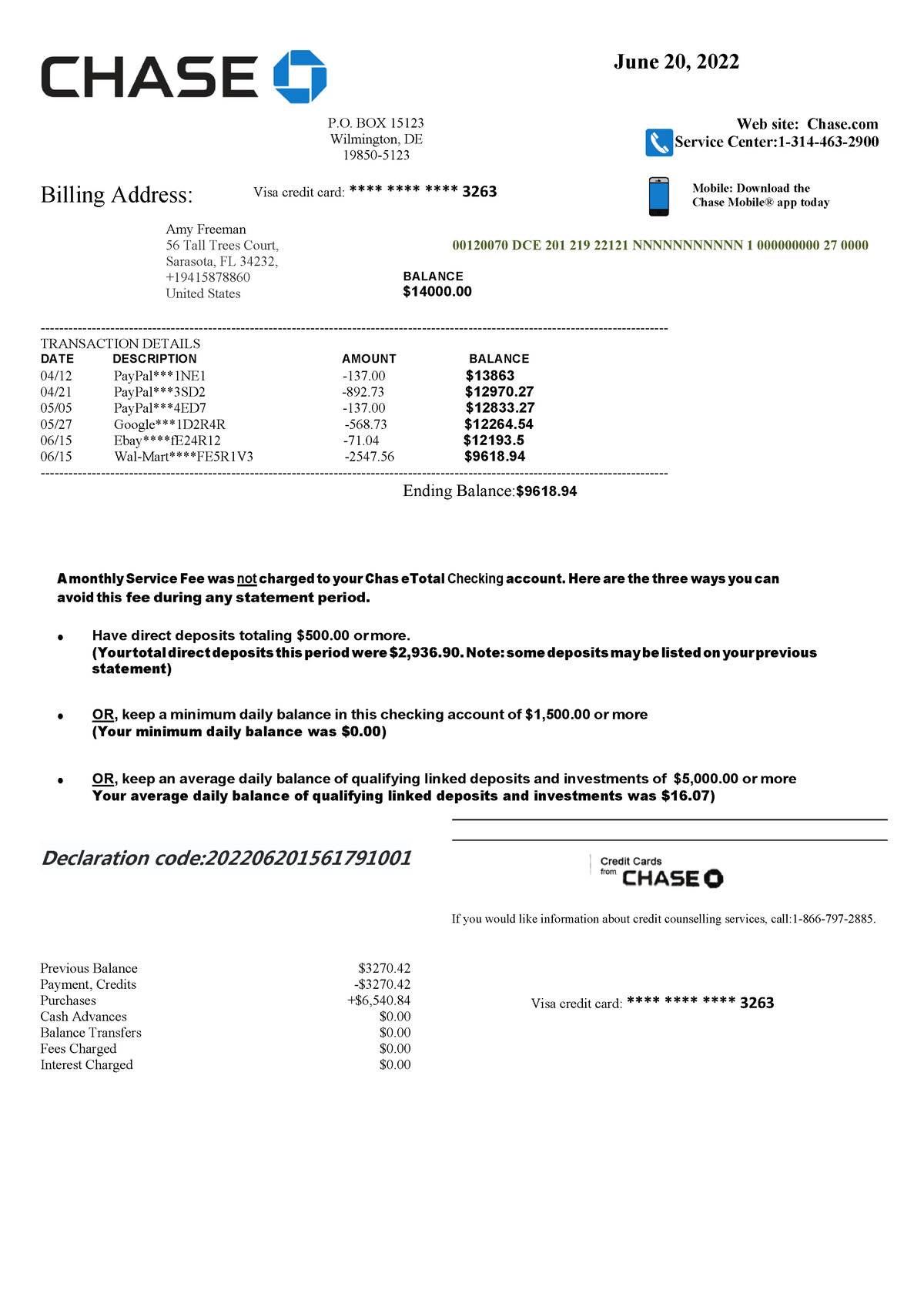

Chase Bank Account Balance Screenshot

Chase Cd Rates 2024 Pdf Free Download Viva Alverta