What Does Billing Address Mean? A Comprehensive Guide For Everyday Transactions

Ever wondered what exactly a billing address is and why it's so important in your daily transactions? If you're like most people, you've probably typed in your billing address countless times without giving it much thought. But here's the deal—understanding what it means can save you from potential headaches down the road. Whether you're shopping online, setting up a subscription, or even paying bills, knowing what a billing address entails is crucial for smooth financial interactions. Let’s dive in and break it all down for you!

Picture this: you're about to purchase that must-have gadget online, and the website asks for your billing address. You type it in, hit submit, and voila! The transaction is complete. But wait—what just happened behind the scenes? A billing address is more than just a line of text; it's a key piece of information that verifies your identity and ensures your payment goes through securely.

In today's digital world, where online transactions happen in the blink of an eye, understanding the role of a billing address can make a big difference. From protecting yourself against fraud to ensuring timely delivery, having a clear grasp of what it means can help you navigate the world of e-commerce with confidence. So, let's get started and unravel the mystery of the billing address together!

- Unpacking The Secrets Of Attractiveness Scale A Deep Dive Into What Makes Us Irresistible

- Hottest Female Politicians In The Us A Closer Look At Their Impact And Influence

What Exactly Is a Billing Address?

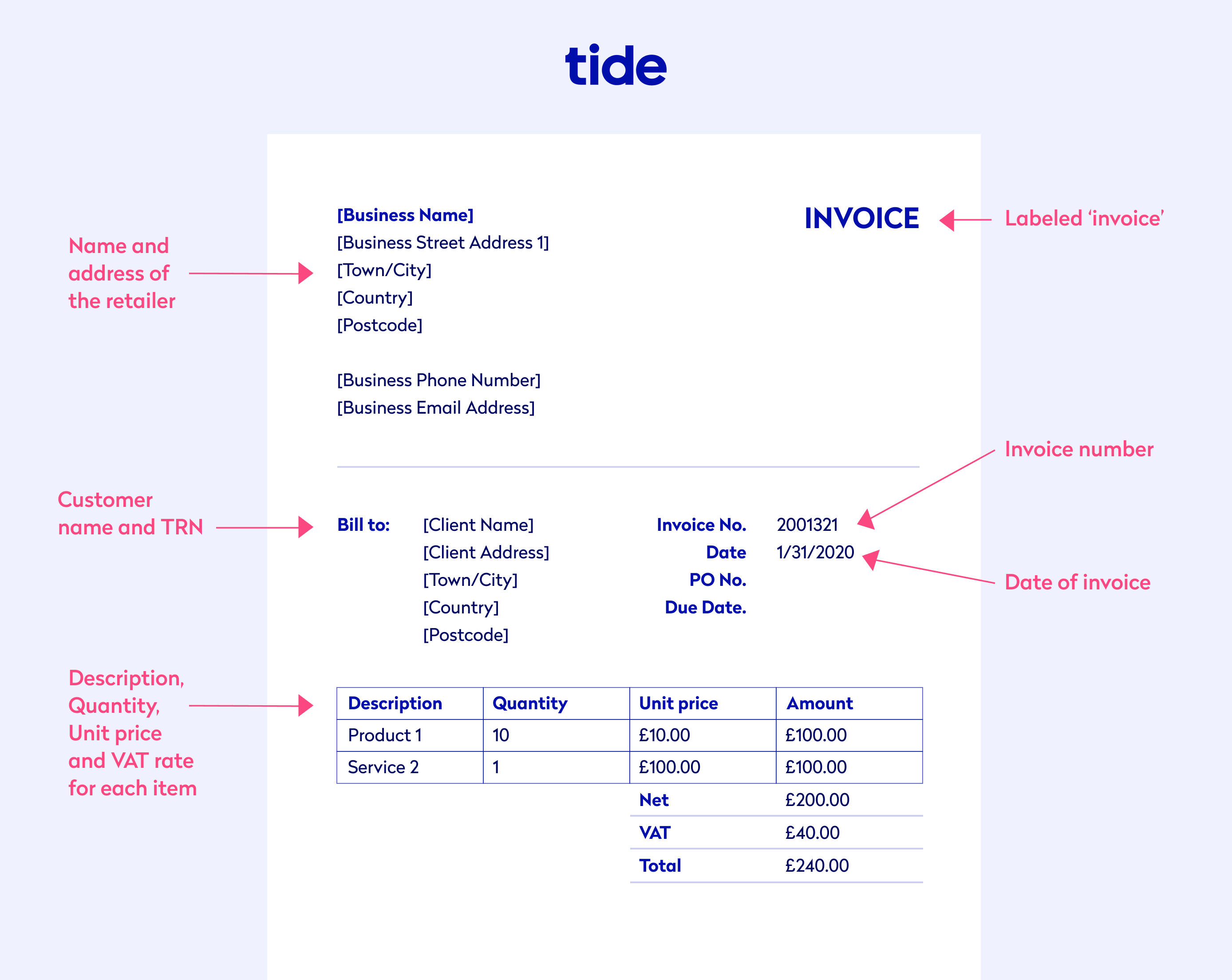

At its core, a billing address is the location where your financial institution or service provider sends your invoices, statements, or other billing-related documents. It's the address linked to your payment method, whether it's a credit card, debit card, or bank account. This could be your home address, office address, or any other location you've designated as your official billing spot.

Think of it like this: your billing address acts as a digital fingerprint that connects you to your financial activities. When you enter it during a transaction, it helps verify that you're the rightful owner of the payment method being used. It's not just about sending paper bills anymore—it's about ensuring secure and accurate transactions in the digital age.

Why Is a Billing Address Important?

The importance of a billing address can't be overstated. Here are some key reasons why it plays such a crucial role in your financial dealings:

- Conor Mcgregor Zodiac Sign Unveiling The Star Power Behind The Notorious Fighter

- When Does Pooh Shiesty Release Date Unveiling The Hype And Details

- Verification: It confirms your identity and ensures that the payment method being used belongs to you.

- Security: By matching the billing address with the cardholder's information, merchants can prevent fraudulent transactions.

- Communication: It serves as the point of contact for receiving important financial documents, such as invoices or statements.

- Shipping Confirmation: Many online retailers compare the billing and shipping addresses to ensure the order is going to the right place.

In short, your billing address is the backbone of secure transactions. Without it, the entire process would be a lot more complicated—and risky!

How Does a Billing Address Work in Online Transactions?

When you're shopping online, the billing address works hand-in-hand with your payment method to ensure everything runs smoothly. Here's how it typically works:

- You select the items you want to buy and proceed to checkout.

- The website prompts you to enter your billing address, along with your payment details.

- The system cross-checks the billing address you provide with the one on file for your payment method.

- If everything matches, the transaction is approved, and your order is processed.

This process happens almost instantly, but it's incredibly important. It helps prevent unauthorized use of your payment method and ensures that the transaction is legitimate.

What Happens If Your Billing Address Doesn't Match?

If the billing address you enter doesn't match the one on file with your bank or card issuer, the transaction might be flagged for review or even declined. This is a security measure designed to protect you from fraud. For example, if someone tries to use your stolen credit card details, the mismatched billing address could alert the system to potential foul play.

However, there are legitimate reasons why your billing address might not match. Maybe you're traveling and using a friend's address temporarily, or perhaps you've recently moved and haven't updated your information yet. In such cases, you might need to contact your bank or card issuer to resolve the issue.

Common Myths About Billing Addresses

There are a few misconceptions floating around about billing addresses that can lead to confusion. Let's clear them up:

Myth 1: Your Billing Address Must Be Your Home Address

Not necessarily! While your home address is often used as your billing address, it doesn't have to be. You can choose any address that you feel comfortable linking to your financial accounts, whether it's a PO box, office address, or even a relative's address. Just make sure it's a location where you can reliably receive important documents if needed.

Myth 2: Billing Address Is the Same as Shipping Address

While they can be the same, they don't have to be. Your billing address is for verification purposes, while your shipping address is where your purchased items will be sent. Many people use different addresses for these purposes, especially when buying gifts or ordering items to a different location.

Myth 3: You Can Skip Providing a Billing Address

Unfortunately, no. Most merchants require a billing address to complete a transaction. Skipping this step could result in your order being rejected or delayed, as the billing address is a key part of the verification process.

How to Choose the Right Billing Address

Selecting the right billing address is important for ensuring smooth transactions and protecting your financial information. Here are a few tips to help you make the right choice:

- Choose a Permanent Address: Opt for an address that won't change frequently, like your home or office address.

- Keep It Updated: If you move or change your address, make sure to update it with your bank or card issuer promptly.

- Consider Security: If you're concerned about privacy, you can use a PO box or a trusted forwarding service as your billing address.

Remember, the billing address you choose should be a place where you can reliably receive important financial documents if needed. It's also a good idea to use the same billing address across all your accounts for consistency.

What to Do If Your Billing Address Changes

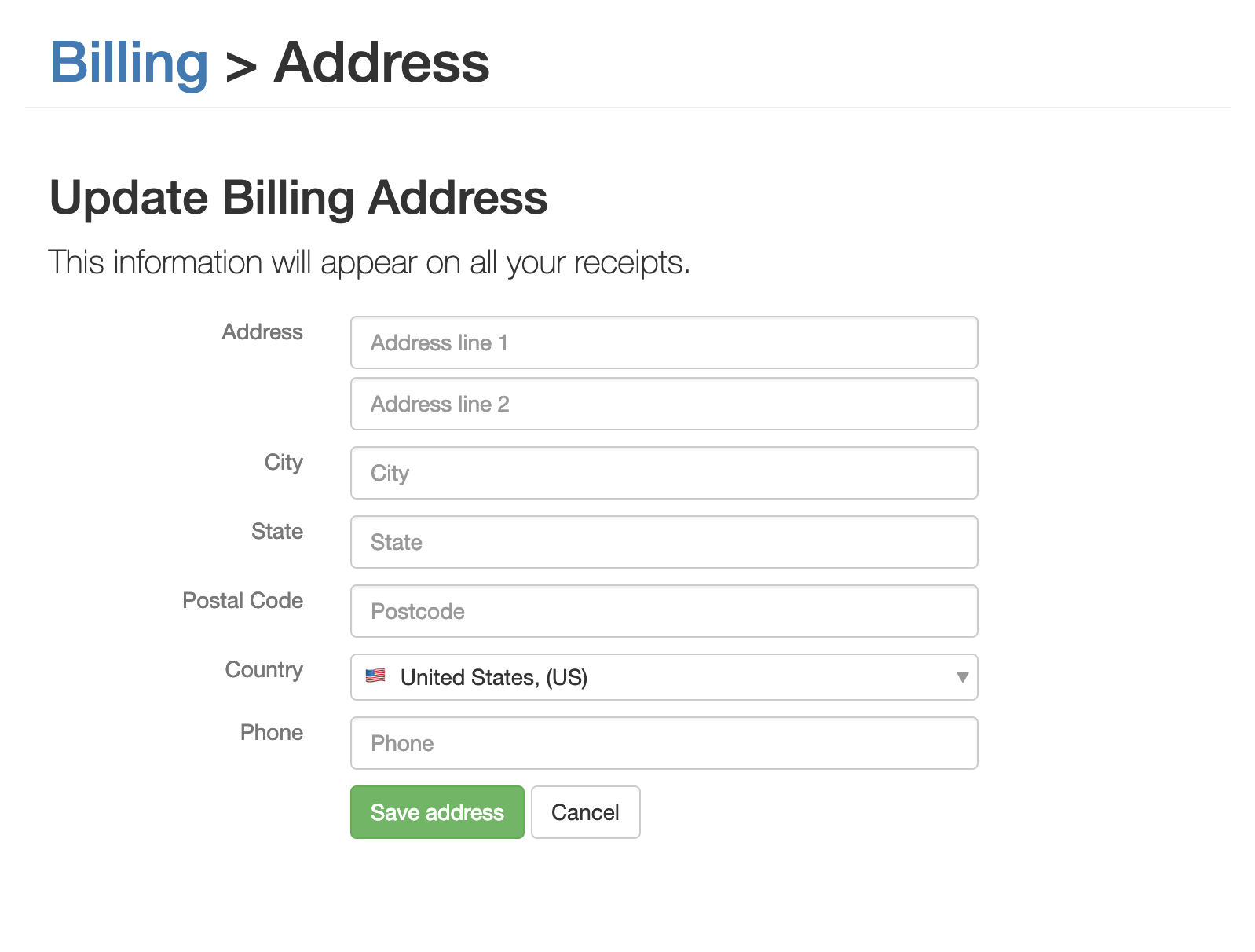

Moving to a new place? Congratulations! But don't forget to update your billing address with your bank, credit card companies, and any other financial institutions you deal with. Here's how you can do it:

- Log in to your account on the institution's website.

- Locate the section for updating personal information or address changes.

- Enter your new billing address and save the changes.

- Double-check that the update was successful by verifying the new address in your account details.

It's also a good idea to notify any online retailers or subscription services you use regularly. This way, you won't miss any important invoices or statements.

What If You Forget to Update Your Billing Address?

If you forget to update your billing address, you might encounter issues like missed invoices, delayed transactions, or even declined payments. To avoid these problems, make it a habit to review and update your personal information regularly, especially after major life events like moving or changing jobs.

The Role of Billing Address in Fraud Prevention

One of the primary reasons billing addresses are so important is their role in preventing fraud. Here's how they help:

- Address Verification System (AVS): Many merchants use AVS to compare the billing address you provide with the one on file with your bank or card issuer. If there's a mismatch, the transaction may be flagged for review.

- Two-Factor Authentication: In some cases, merchants may require additional verification, such as entering a one-time code sent to your phone or email, to confirm your identity.

- Monitoring for Suspicious Activity: Financial institutions keep an eye on unusual transactions, such as those originating from unfamiliar billing addresses, and may reach out to you if they suspect fraud.

By using your billing address as a verification tool, merchants and financial institutions can help protect you from unauthorized transactions and potential scams.

Best Practices for Managing Your Billing Address

To ensure your billing address works for you and not against you, follow these best practices:

Tip 1: Keep It Simple

Use the same billing address across all your accounts to avoid confusion. This makes it easier to manage your financial information and reduces the risk of errors.

Tip 2: Monitor Your Accounts Regularly

Check your accounts frequently for any suspicious activity. If you notice anything unusual, report it to your bank or card issuer immediately.

Tip 3: Protect Your Information

Be cautious when sharing your billing address online. Only enter it on secure, reputable websites, and avoid storing it unnecessarily.

Conclusion: Why Understanding Billing Addresses Matters

Now that you know what a billing address is and why it's so important, you're better equipped to navigate the world of online transactions with confidence. Remember, your billing address is more than just a piece of information—it's a key part of your financial security. By choosing the right billing address, keeping it updated, and following best practices, you can ensure smooth and secure transactions every time.

So, the next time you're asked for your billing address, you'll know exactly what it means and why it matters. And if you have any questions or concerns, don't hesitate to reach out to your bank or card issuer for guidance.

Call to Action: Share your thoughts on billing addresses in the comments below! Have you ever encountered issues with mismatched billing addresses? How did you resolve them? Let's start a conversation and help each other out!

Table of Contents

- What Does Billing Address Mean?

- What Exactly Is a Billing Address?

- Why Is a Billing Address Important?

- How Does a Billing Address Work in Online Transactions?

- Common Myths About Billing Addresses

- How to Choose the Right Billing Address

- What to Do If Your Billing Address Changes

- The Role of Billing Address in Fraud Prevention

- Best Practices for Managing Your Billing Address

- Conclusion: Why Understanding Billing Addresses Matters

- Lara Bonilla The Rising Star Taking The World By Storm

- Where Is Dog The Bounty Hunter From Unveiling The Origins Of A Tv Legend

How can I update my billing address? DocHub

What Is the Difference Between a Billing Address and a Shipping Address?

What is an invoice? Raising them & getting paid Tide Business