Aflac Payouts: The Ultimate Guide To Understanding And Maximizing Your Benefits

When life throws unexpected curveballs, having a solid safety net can make all the difference. Aflac payouts are designed to provide that extra layer of financial protection when you need it most. Whether it's a serious illness, accidental injury, or other unforeseen circumstances, Aflac steps in to ease the financial burden. But how exactly do these payouts work, and what should you know before filing a claim? Let's dive into the nitty-gritty details.

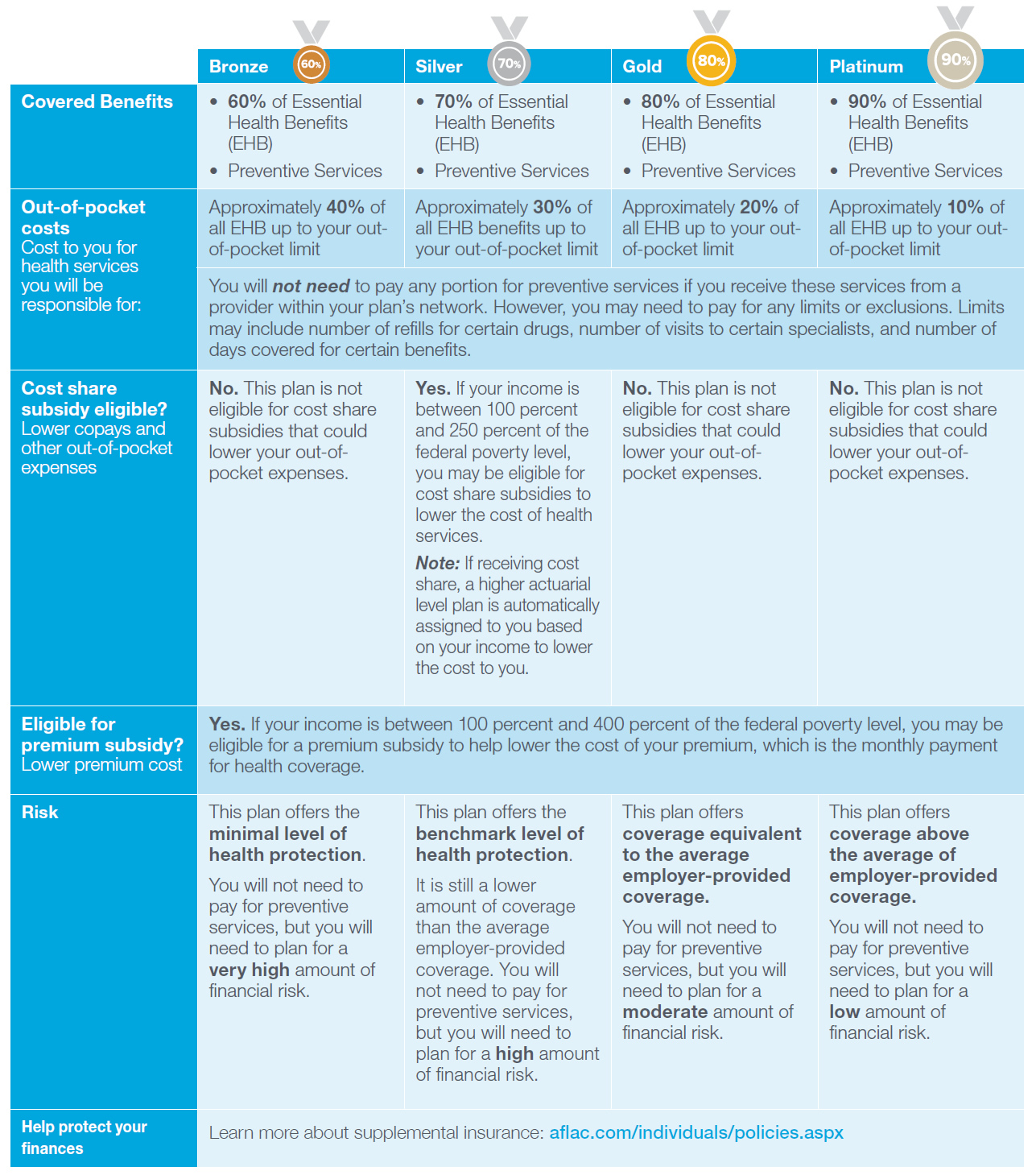

Imagine this: you're dealing with a medical issue, and on top of everything else, you're stressing about the bills piling up. That's where Aflac comes in. Their supplemental insurance plans are crafted to cover those gaps that traditional health insurance might leave behind. Think of Aflac as your personal financial superhero, swooping in to save the day with cash benefits when you're down and out.

But hold up, there's more to Aflac payouts than just writing a check. It's about understanding your policy, knowing what's covered, and navigating the claims process like a pro. In this guide, we'll break it all down for you, step by step, so you're fully equipped to make the most out of your Aflac coverage. Let's get started!

- How To Start A Solar Eclipse In Terraria A Beginners Guide

- Sephora Donations Where Glamour Meets Generosity

What Are Aflac Payouts?

Aflac payouts refer to the cash benefits you receive when you file a successful claim under your Aflac insurance policy. These payments are designed to help cover expenses that aren't fully covered by your primary health insurance. From hospital stays to cancer treatments, Aflac has got your back with various plans tailored to different needs. The best part? You get the money directly, so you decide how to use it—whether it's paying bills, covering daily expenses, or even treating yourself to a little self-care.

But here's the deal: not all claims are created equal. The amount you receive depends on the specifics of your policy and the event triggering the payout. For instance, if you're hospitalized due to an accident, your payout could differ from one resulting from a critical illness. It's all about matching the right plan to your unique situation, which we'll explore in more detail later.

How Do Aflac Payouts Work?

Now that you know what Aflac payouts are, let's talk about how they actually work. Once you've purchased an Aflac policy, you're set to file a claim whenever a covered event occurs. The claims process is pretty straightforward, but there are some key steps to keep in mind. First, you'll need to gather all the necessary documentation, like medical records and proof of the event. Then, you submit your claim either online or via mail, depending on your preference.

- King Of Hill Cast The Ultimate Guide To Your Favorite Animated Crew

- Number To Come The Future Is Bright And Its All About Numbers

After submission, Aflac reviews your claim to ensure it meets the policy's criteria. If everything checks out, you'll receive your payout, usually within a few days. It's worth noting that Aflac boasts one of the fastest claims processing times in the industry, often paying claims within just a couple of business days. That kind of speed can be a real lifesaver when you're in a tight spot financially.

Types of Aflac Policies and Their Payouts

Aflac offers a wide range of policies, each with its own set of benefits and payout structures. Understanding the differences can help you choose the right plan for your needs. Let's take a closer look at some of the most popular Aflac policies and what they offer.

Cancer Insurance

Aflac's cancer insurance provides financial protection specifically for cancer-related expenses. If you're diagnosed with cancer, your policy will pay out a lump sum benefit, which you can use however you see fit. This could include covering treatment costs, travel expenses to specialist appointments, or even taking a much-needed break to focus on recovery. According to Aflac, cancer claims account for a significant portion of their payouts each year, highlighting the importance of this coverage.

Accident Insurance

Accidents happen, and when they do, the costs can add up fast. Aflac's accident insurance offers payouts for a variety of accidental injuries, from broken bones to concussions. The benefits vary depending on the severity of the injury and the specific terms of your policy. For example, a minor injury might result in a smaller payout, while a more serious accident could trigger a larger benefit. It's all about having peace of mind knowing you're covered no matter what.

Hospital Insurance

Hospital stays can be expensive, even with traditional health insurance. That's where Aflac's hospital insurance comes in. This policy pays out benefits for each day you're hospitalized, up to a specified maximum. The payout is typically a flat rate per day, so you know exactly what to expect. Whether you're dealing with surgery, childbirth, or any other hospital-related expense, Aflac's hospital insurance can help ease the financial strain.

Factors Affecting Aflac Payouts

Not all Aflac payouts are the same, and several factors can influence the amount you receive. Here's a breakdown of the key elements that play a role in determining your payout:

- Policy Type: Different policies offer different benefits, so the type of coverage you have directly impacts your payout.

- Event Severity: More severe events, like major surgeries or critical illnesses, usually result in higher payouts compared to minor incidents.

- Policy Limits: Each policy has its own maximum payout limit, so it's important to understand these caps when choosing your coverage.

- Claim Submission: Timely and accurate submission of your claim can ensure a smoother process and faster payout.

Understanding these factors can help you set realistic expectations and make informed decisions about your Aflac coverage. It's all about finding the right balance between cost and coverage to suit your individual needs.

Steps to File an Aflac Claim

Filing an Aflac claim doesn't have to be a headache. With a few simple steps, you can get the ball rolling and start the process of receiving your payout. Here's what you need to do:

Gather Documentation

Before you even start the claims process, make sure you have all the necessary documentation in order. This includes medical records, incident reports, and any other relevant paperwork. The more thorough you are at this stage, the smoother the rest of the process will be.

Submit Your Claim

Once you've gathered everything, it's time to submit your claim. You can do this either online through Aflac's website or by mailing in a paper form. Online submission is usually faster and more convenient, but if you prefer the old-school method, mailing is still an option. Just be sure to keep a copy of everything you send for your records.

Track Your Claim

After submission, you can track the status of your claim through Aflac's online portal. This allows you to stay updated on the progress and address any issues that may arise. If you have any questions or concerns, Aflac's customer service team is available to assist you every step of the way.

Tips for Maximizing Aflac Payouts

Getting the most out of your Aflac policy requires a bit of strategy. Here are some tips to help you maximize your payouts:

- Review Your Policy Regularly: Make sure you fully understand the terms and conditions of your policy. Knowing what's covered can help you make the most of your benefits.

- File Claims Promptly: The sooner you file a claim, the faster you'll receive your payout. Don't delay—act quickly to ensure timely processing.

- Stay Organized: Keep all your documentation in one place. This will save you time and hassle when it comes to filing claims or addressing any issues that may arise.

- Communicate with Aflac: If you have any questions or concerns, don't hesitate to reach out to Aflac's customer service. They're there to help and can provide valuable guidance throughout the process.

By following these tips, you can ensure you're getting the full value of your Aflac coverage and making the most of your financial protection.

Common Misconceptions About Aflac Payouts

There are a few misconceptions floating around about Aflac payouts that could lead to confusion or missed opportunities. Let's clear up some of the most common ones:

Aflac Only Covers Major Events

Contrary to popular belief, Aflac doesn't just cover major medical events. Depending on your policy, you could receive payouts for a wide range of incidents, from minor injuries to routine hospital stays. It's all about choosing the right coverage for your needs.

Payouts Are Taxable

Another misconception is that Aflac payouts are always taxable. In reality, the taxability of your benefits depends on how you paid your premiums. If you paid with after-tax dollars, your payouts are typically tax-free. However, if your employer covered the cost, the benefits might be considered taxable income. It's always a good idea to consult with a tax professional to understand your specific situation.

Data and Statistics on Aflac Payouts

Numbers can paint a powerful picture, and when it comes to Aflac payouts, the data speaks volumes. Did you know that Aflac pays out over $5 million in claims every day? That's a staggering amount that highlights the company's commitment to financial protection. Additionally, Aflac boasts a claims approval rate of over 98%, underscoring their dedication to customer satisfaction.

According to recent statistics, cancer-related claims account for nearly 30% of all Aflac payouts, followed closely by accident and hospital claims. These numbers reflect the real-world impact of Aflac's policies and the importance of having comprehensive coverage. When you consider that Aflac has been in business for over 70 years, paying out over $100 billion in benefits, it's clear they're a trusted name in the insurance industry.

Customer Testimonials and Success Stories

Hearing from real Aflac customers can provide valuable insights into the benefits of their payouts. Take Sarah, for example, who was diagnosed with breast cancer. Her Aflac cancer insurance not only covered her treatment costs but also allowed her to take time off work to focus on recovery. Or consider John, who suffered a serious car accident. His Aflac accident insurance ensured he could cover his medical bills without dipping into his savings.

These stories, among countless others, demonstrate the tangible impact of Aflac payouts on people's lives. They're more than just numbers—they're lifelines for those facing challenging times.

Conclusion

In conclusion, Aflac payouts offer a vital layer of financial protection that can make all the difference during tough times. From understanding the different types of policies to navigating the claims process, this guide has provided you with the tools and knowledge to maximize your benefits. Remember, the key to making the most of your Aflac coverage is staying informed and proactive.

So, what's next? Take action by reviewing your current policy, gathering all necessary documentation, and filing claims promptly when needed. Don't hesitate to reach out to Aflac's customer service for any questions or assistance. And finally, share this article with friends and family who might benefit from the information. Together, we can all build stronger financial safety nets.

Table of Contents

- What Are Aflac Payouts?

- How Do Aflac Payouts Work?

- Types of Aflac Policies and Their Payouts

- Factors Affecting Aflac Payouts

- Steps to File an Aflac Claim

- Tips for Maximizing Aflac Payouts

- Common Misconceptions About Aflac Payouts

- Data and Statistics on Aflac Payouts

- Customer Testimonials and Success Stories

- Conclusion

- Mountain Gate Family Restaurant A Culinary Haven For Every Palate

- Exploring The Best Asian Grocery Syracuse Has To Offer

Aflac Accident Insurance Coverage Financial Report

Aflac Home Insurance Reviews Homemade Ftempo

Aflac Shortterm Disability Pay Chart Portal.posgradount.edu.pe