California Department Of Taxes And Fees: Your Ultimate Guide To Navigating The System

Alright folks, let me tell you something straight up. If you're living in California or planning to set up shop here, you better get familiar with the California Department of Taxes and Fees. This isn’t just another bureaucratic department; it's a crucial part of your financial life if you're in the Golden State. Whether you're paying taxes, registering your business, or figuring out vehicle fees, this department has got its hands in just about everything. So, buckle up, because we're diving deep into this world of tax forms, fees, and everything in between.

Now, I know what you're thinking. Taxes and fees sound boring, right? But trust me, understanding how the California Department of Taxes and Fees operates can save you a ton of headaches and possibly even some cash. Think about it—avoiding penalties, knowing deadlines, and staying compliant are all part of the game. And hey, who doesn’t want to keep more of their hard-earned money?

In this guide, we'll break down everything you need to know about the California Department of Taxes and Fees. We’ll cover the basics, dive into specific areas like business taxes, personal income taxes, and even those pesky vehicle registration fees. By the end of this, you'll feel like a pro when it comes to navigating the system. So, let’s get started, shall we?

- Kashdoll Age Unveiling The Life Career And Personal Journey

- Stanley Taco Bell The Rise Of A Tiktok Sensation And His Taco Bell Obsession

What Exactly is the California Department of Taxes and Fees?

Let’s start with the basics. The California Department of Taxes and Fees is essentially the arm of the state government that handles all things related to taxation and various fees. This includes everything from state income taxes to sales and use taxes, excise taxes, and even special district fees. It’s a big deal because it funds essential services like education, healthcare, infrastructure, and public safety across the state.

Now, here’s the kicker. California has one of the most complex tax systems in the country. The department works closely with other agencies, like the Franchise Tax Board and the Board of Equalization, to ensure everything runs smoothly. But hey, don’t let that scare you. With the right information, you can navigate this system like a champ.

Why Should You Care About the California Department of Taxes and Fees?

Here’s the deal. If you live, work, or do business in California, the department affects you one way or another. For individuals, it’s all about paying your fair share of state income taxes, understanding property taxes, and dealing with vehicle registration fees. For businesses, it’s a whole different ballgame. You’ve got to worry about sales tax, payroll taxes, and even environmental fees.

- The Real World Boston Sean Duffy A Deep Dive Into The Iconic Mtv Star

- Cleanest City In Us Discovering Americas Green Havens

And let’s not forget about those pesky penalties and interest if you don’t stay on top of things. The department is pretty serious about compliance, and they have the power to hit you with some hefty fines if you slip up. So, yeah, paying attention to this stuff is crucial if you want to avoid trouble.

Key Areas Covered by the California Department of Taxes and Fees

1. Personal Income Taxes

First up, we’ve got personal income taxes. This is probably the most familiar area for most people. If you earn money in California, you’re required to pay state income taxes. The rates vary depending on your income level, and there are a bunch of deductions and credits you can take advantage of. The good news? California offers a progressive tax system, which means lower-income earners pay less than higher-income earners.

2. Business Taxes

If you’re running a business in California, you’ve got a lot to think about. There’s the Corporation Franchise Tax, which applies to corporations doing business in the state. Then there’s the California Alternative Minimum Tax, which ensures that big companies can’t avoid paying their fair share. Oh, and don’t forget about sales and use taxes if you’re selling goods or services.

3. Sales and Use Taxes

Sales and use taxes are a big deal in California. The state has one of the highest sales tax rates in the country, and it can vary depending on where you are. For example, Los Angeles has a different rate than San Diego. This tax applies to most retail sales, leases, and rentals of tangible personal property. And if you buy something out of state but use it in California, you might still owe use tax.

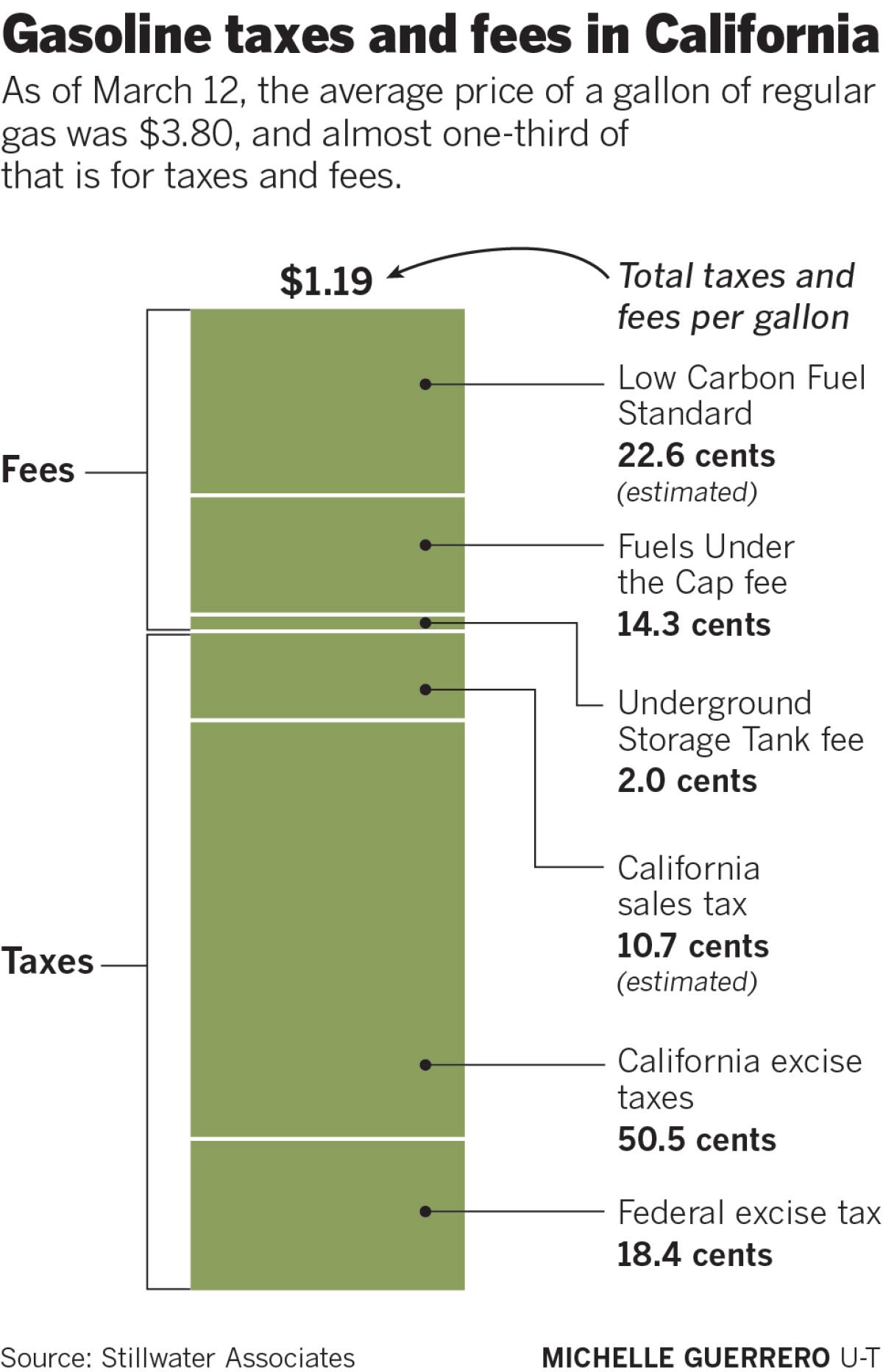

4. Excise Taxes

Excise taxes are levied on specific goods and services. Think about things like gasoline, cigarettes, and alcohol. These taxes are usually built into the price of the product, so you might not even realize you’re paying them. But trust me, they add up. The department uses these taxes to fund specific programs and infrastructure projects across the state.

5. Vehicle Registration Fees

Oh, and let’s not forget about those vehicle registration fees. If you own a car in California, you’ve got to pay to register it every year. This fee is based on the value of your vehicle, and it helps fund transportation programs and road maintenance. And if you’re selling or buying a car, there are additional fees and taxes you need to consider.

How to Navigate the California Department of Taxes and Fees

1. Stay Informed

The first step in navigating the system is to stay informed. Keep up with changes in tax laws and regulations. The department regularly updates its website with the latest information, so make sure you’re checking in regularly. And hey, if you’re not sure about something, don’t be afraid to reach out for help. There are plenty of resources available, from online guides to professional tax advisors.

2. Use Online Tools

These days, the department offers a ton of online tools to make your life easier. You can file your taxes electronically, pay fees online, and even check the status of your refund. It’s all pretty straightforward, and it saves you a ton of time compared to dealing with paper forms and snail mail.

3. Seek Professional Help

If you’re feeling overwhelmed, it’s okay to seek professional help. Tax advisors and accountants can be a lifesaver, especially if you’ve got a complicated situation. They can help you navigate the system, find deductions and credits you might have missed, and ensure you’re in compliance with all the rules and regulations.

Common Mistakes to Avoid

Alright, let’s talk about some common mistakes people make when dealing with the California Department of Taxes and Fees. First up, missing deadlines. Whether it’s filing your taxes or paying your vehicle registration fee, missing a deadline can cost you big time in penalties and interest. So, set reminders, mark your calendar, and stay on top of things.

Another big mistake is not keeping good records. You need to keep track of all your receipts, invoices, and other financial documents. This will make tax season a lot less stressful and help you avoid any potential audits. And lastly, don’t try to hide income or underreport your taxes. The department has sophisticated systems to catch fraud, and the consequences can be severe.

Data and Statistics

Here are some interesting stats to give you a better idea of what we’re dealing with. In 2022, the California Department of Taxes and Fees collected over $170 billion in revenue. That’s a massive amount of money that funds essential services across the state. And did you know that California’s sales tax rate is one of the highest in the country, averaging around 8.25%? Yikes!

Another fun fact? The department processes millions of tax returns every year. That’s a lot of paperwork, even with all the digital tools they have at their disposal. And let’s not forget about those vehicle registration fees. In 2022 alone, the department collected over $2 billion in vehicle-related fees. That’s a lot of cars!

Conclusion

So, there you have it, folks. The California Department of Taxes and Fees might seem intimidating at first, but with the right information and tools, you can navigate it like a pro. Whether you’re dealing with personal income taxes, business taxes, or vehicle registration fees, staying informed and organized is key.

Remember to stay on top of deadlines, keep good records, and don’t hesitate to seek professional help if you need it. And hey, if you’ve got any questions or comments, feel free to drop them below. We’d love to hear from you. Oh, and don’t forget to share this guide with your friends and family. Knowledge is power, and the more we know, the better we can navigate this sometimes complicated world of taxes and fees.

Table of Contents

- What Exactly is the California Department of Taxes and Fees?

- Why Should You Care About the California Department of Taxes and Fees?

- Key Areas Covered by the California Department of Taxes and Fees

- How to Navigate the California Department of Taxes and Fees

- Common Mistakes to Avoid

- Data and Statistics

- Conclusion

- Petrie The Unsung Hero Of Archaeology You Need To Know

- Whorsquos The Owner Of Crocs Unveiling The Mastermind Behind Your Favorite Shoes

How much are you paying in taxes and fees for gasoline in California

California Tax Payment Plans

What Are the Consequences of Not Paying Sales Tax? Brotman Law