Chase Foreign Exchange: Your Ultimate Guide To Seamless Currency Conversion

Ever wondered how Chase handles foreign exchange? You're not alone. In today's globalized world, understanding currency conversion is crucial for travelers, investors, and business owners alike. Chase Foreign Exchange has become a go-to solution for many, offering convenience and competitive rates. But how does it really work, and is it the right choice for you? Let's dive in and find out!

When it comes to managing finances across borders, Chase Foreign Exchange stands out as a reliable option. Whether you're planning an international trip or managing cross-border transactions, knowing how Chase handles foreign exchange can save you time, money, and hassle. So, buckle up as we explore everything you need to know about this service.

In this guide, we'll break down the ins and outs of Chase Foreign Exchange, from its benefits and drawbacks to tips for maximizing your savings. By the end, you'll have all the tools you need to make informed decisions about your foreign currency needs. Let's get started!

- Cumberland River Body Discoveries Unraveling The Secrets Beneath The Waters

- 30 Rock Cast A Deep Dive Into The Iconic Team That Made Tv History

What is Chase Foreign Exchange?

Chase Foreign Exchange is a service provided by JPMorgan Chase Bank that allows customers to convert one currency into another. It's designed to cater to both personal and business needs, offering a range of options for international transactions. Whether you're withdrawing cash overseas or sending money to a foreign account, Chase makes it easier to navigate the complexities of currency conversion.

How Does Chase Foreign Exchange Work?

The process is pretty straightforward. When you use Chase Foreign Exchange, the bank converts your domestic currency into the desired foreign currency at the prevailing exchange rate. This can be done through various channels, including ATMs, online banking, or in-branch services. The key here is understanding the fees and rates associated with each method, as they can vary significantly.

- ATM withdrawals: Convenient but may come with higher fees.

- Online transfers: Ideal for large transactions with potentially lower fees.

- In-branch services: Best for face-to-face assistance and customized solutions.

Why Choose Chase for Foreign Exchange?

There are several reasons why Chase stands out in the foreign exchange market. First and foremost, it's a trusted name in banking, which gives customers peace of mind. Additionally, Chase offers competitive exchange rates and a wide range of services tailored to different needs.

- How To Check On Flight Status Frontier Like A Pro

- Remembering Freddie Steinmark The Untold Story Behind Freddie Steinmark Death

Benefits of Using Chase Foreign Exchange

Let's take a closer look at what makes Chase Foreign Exchange a top choice for many:

- Security: As a major financial institution, Chase ensures your transactions are safe and secure.

- Convenience: Access your foreign exchange services anytime, anywhere through Chase's digital platforms.

- Competitive Rates: Chase often provides better exchange rates compared to smaller currency exchange providers.

- Customer Support: With 24/7 support, you can get help whenever you need it.

Understanding Exchange Rates and Fees

One of the most important aspects of Chase Foreign Exchange is understanding the exchange rates and fees involved. These factors can significantly impact the overall cost of your transactions, so it's crucial to be informed.

Exchange Rates

Exchange rates fluctuate based on market conditions, and Chase typically uses the interbank rate as a benchmark. However, they may add a markup to cover their costs and profit margin. To get the best rate, consider timing your transactions when the market is favorable.

Fees

Fees can vary depending on the type of transaction and the method used. Here's a breakdown:

- ATM Withdrawal Fee: Typically around $5 per transaction, plus any fees charged by the foreign ATM operator.

- International Wire Transfer Fee: Ranges from $5 to $30, depending on the amount and destination.

- Currency Conversion Fee: A percentage of the transaction amount, usually around 1-3%.

Tips for Maximizing Your Savings

Now that you know the basics, here are some tips to help you save money when using Chase Foreign Exchange:

1. Compare Rates

Before making a transaction, compare Chase's exchange rates with other providers. This will give you a better idea of whether you're getting a good deal.

2. Use Chase Debit or Credit Cards

When traveling abroad, using a Chase debit or credit card can be more cost-effective than withdrawing cash from ATMs. These cards often have lower foreign transaction fees and better exchange rates.

3. Plan Ahead

Timing is everything. Try to make your transactions during periods of favorable exchange rates to maximize your savings.

Common Misconceptions About Chase Foreign Exchange

There are a few myths surrounding Chase Foreign Exchange that we need to clear up:

1. "Chase Always Offers the Best Rates"

While Chase often provides competitive rates, it's not always the cheapest option. Always compare rates before making a decision.

2. "All Chase Accounts Qualify for Foreign Exchange Services"

Not all Chase accounts offer the same level of foreign exchange services. Some premium accounts may have additional benefits, so check your account details to see what's available to you.

Real-Life Examples of Chase Foreign Exchange

Let's look at a couple of real-life scenarios where Chase Foreign Exchange proved to be a lifesaver:

Scenario 1: Traveling to Europe

John, a frequent traveler, was planning a trip to Europe. Instead of exchanging money at the airport, he used his Chase debit card to withdraw euros from ATMs. This saved him both time and money, as airport exchange rates are notoriously unfavorable.

Scenario 2: Sending Money to Family Abroad

Sarah needed to send money to her family in India. She used Chase's international wire transfer service, which offered a competitive exchange rate and a reasonable fee. Her family received the funds within a few days, ensuring they had the support they needed.

Chase Foreign Exchange vs. Competitors

How does Chase stack up against other foreign exchange providers? Let's compare:

Chase vs. Western Union

While Western Union is known for its speed, Chase often offers better exchange rates and lower fees for larger transactions. However, Western Union might be a better option for urgent transfers.

Chase vs. PayPal

PayPal is convenient for online transactions, but Chase typically provides better exchange rates for large sums. If you're sending money to a friend or family member, PayPal might be more user-friendly, but for business purposes, Chase could be the better choice.

Future Trends in Foreign Exchange

As technology continues to evolve, so does the foreign exchange market. Chase is staying ahead of the curve by integrating innovative solutions into its services. Some trends to watch out for include:

- Blockchain technology for faster and cheaper transactions.

- AI-driven tools for predicting currency fluctuations.

- Increased adoption of digital wallets for seamless cross-border payments.

Conclusion

Chase Foreign Exchange offers a reliable and convenient solution for managing your international currency needs. By understanding how it works and following the tips outlined in this guide, you can make the most of this service and save money in the process.

So, whether you're planning a dream vacation or expanding your business globally, Chase Foreign Exchange has got you covered. Don't forget to compare rates, plan ahead, and take advantage of the tools and resources available to you.

Now it's your turn! Have you used Chase Foreign Exchange before? What was your experience like? Share your thoughts in the comments below, and don't forget to check out our other articles for more tips and insights.

Table of Contents

- What is Chase Foreign Exchange?

- How Does Chase Foreign Exchange Work?

- Why Choose Chase for Foreign Exchange?

- Understanding Exchange Rates and Fees

- Tips for Maximizing Your Savings

- Common Misconceptions About Chase Foreign Exchange

- Real-Life Examples of Chase Foreign Exchange

- Chase Foreign Exchange vs. Competitors

- Future Trends in Foreign Exchange

- Conclusion

- Inside The World Of North Carolina Governors Role And Responsibilities

- Asherah Poles In The Bible Unveiling The Mysteries Of Ancient Worship

Chase Bank Foreign Currency Exchange (2024)

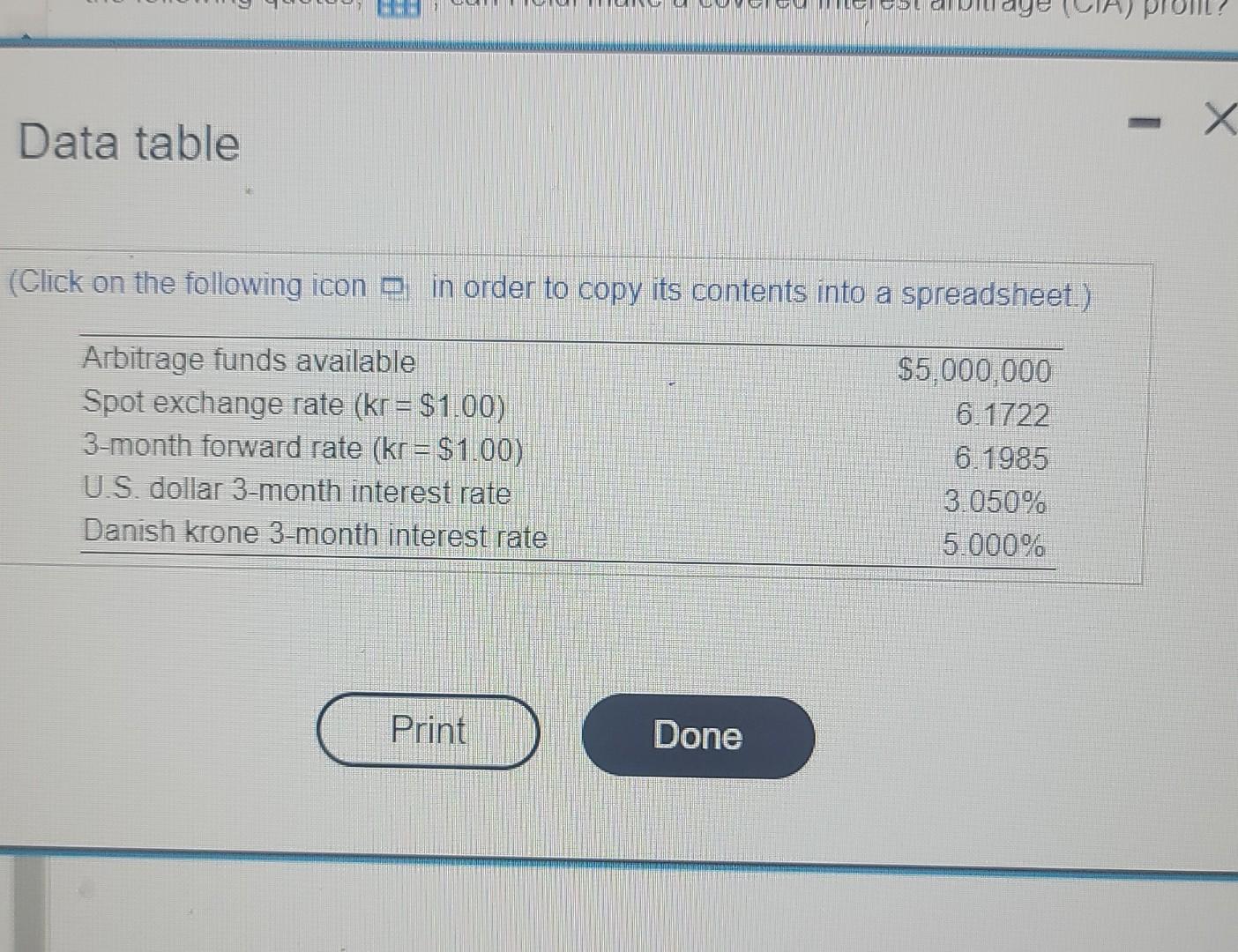

Solved Copenhagen Covered (A). Heidi Høi Jensen, a foreign

/foreign-exchange-1076728392-6a922db856944a8f953dfec721b14a78.jpg)

Currency Carry Trade What is it and how does it work? IG Community