What Is Netspend Bank? Your Ultimate Guide To Understanding This Game-Changer In Banking

Let’s be real, the world of banking has evolved so much over the years that sometimes it feels like we're living in a sci-fi movie. And one name that’s been making waves is Netspend Bank. But what exactly is Netspend Bank? Is it a traditional bank, an app, or some kind of futuristic financial wizardry? Stick around, because we’re about to break it down for you in a way that’ll make you feel like a finance pro by the end of this article.

Now, if you’ve ever found yourself scratching your head while trying to figure out how prepaid cards, digital banking, and financial inclusion all fit together, you’re not alone. Netspend Bank has been quietly revolutionizing the way people manage their money, especially those who may not have access to traditional banking services. It’s like the underdog of the banking world, but with a twist – it’s here to empower everyone.

Before we dive deep into the nitty-gritty, let’s set the stage. Netspend Bank isn’t just another bank; it’s a solution designed to help people take control of their finances without the hassle of hidden fees, complicated processes, or the need for a stellar credit score. If that sounds too good to be true, trust me, it’s not. So, let’s get started and uncover everything you need to know about Netspend Bank.

- Sephora Donations Where Glamour Meets Generosity

- How Old Is Bo Derek Discovering The Age And Journey Of A Hollywood Legend

What Exactly is Netspend Bank? Breaking It Down

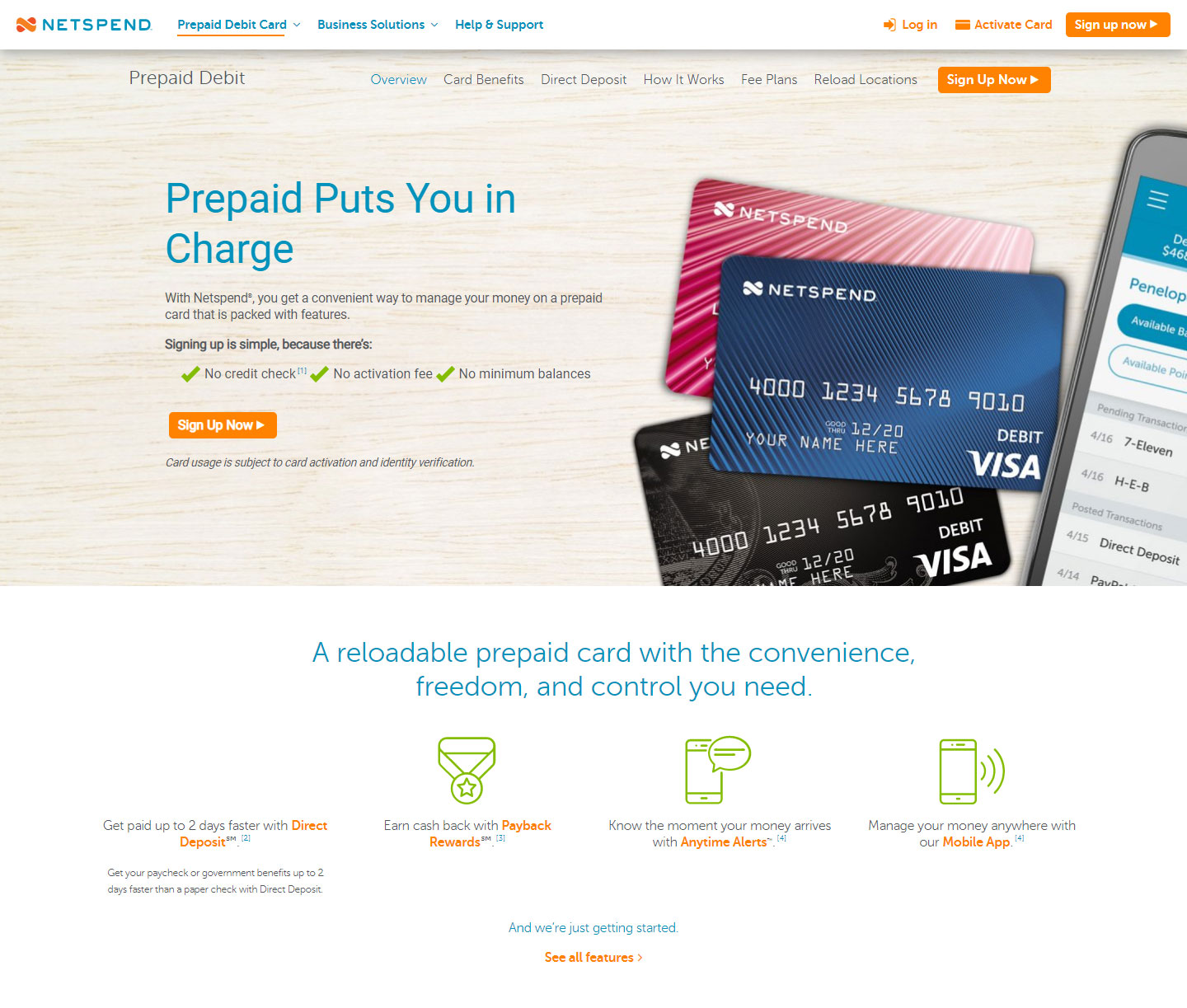

Alright, so here’s the deal. Netspend Bank isn’t your typical brick-and-mortar bank where you walk in wearing your best outfit to talk to a teller. Instead, it’s a prepaid card service provider that offers a range of financial products aimed at giving people more control over their money. Think of it as a digital wallet on steroids, designed to simplify your financial life.

What makes Netspend Bank stand out is its focus on accessibility. Whether you’re someone who prefers managing your finances on the go or someone who doesn’t want to deal with the rigmarole of traditional banking, Netspend has got your back. Plus, it’s super easy to use – all you need is a smartphone and an internet connection, and boom, you’re good to go.

Why Netspend Bank Matters in Today’s World

In today’s fast-paced world, having access to convenient, reliable financial services is a must. Netspend Bank steps in to fill the gaps that traditional banks often leave behind. For instance, did you know that millions of people in the U.S. are considered “unbanked” or “underbanked”? This means they either don’t have a bank account or don’t have access to the full range of financial services that most of us take for granted.

- Examples Of Ethos Pathos And Logos In Ads A Deep Dive Into Persuasive Marketing

- Pink Hair Elf A Magical Trend Thats Taking The World By Storm

Netspend Bank bridges this gap by offering prepaid cards, mobile banking, and other financial tools that make it easy for anyone to manage their money. No credit checks, no minimum balance requirements, and no hidden fees. It’s like a breath of fresh air in the often suffocating world of traditional banking.

Key Features of Netspend Bank

Now that we’ve established what Netspend Bank is, let’s talk about what it actually offers. Here’s a quick rundown of the key features that make Netspend Bank a game-changer:

- Prepaid Debit Cards: These cards work just like regular debit cards, but without the need for a traditional bank account. Load them with money, and you’re ready to go.

- Mobile Banking App: Manage your finances on the go with Netspend’s user-friendly app. Check your balance, pay bills, and transfer money – all from your phone.

- No Credit Checks: Unlike traditional banks, Netspend doesn’t require a credit check to open an account or get a card. This makes it accessible to people who may have struggled with credit in the past.

- Direct Deposit: Get your paycheck deposited directly into your Netspend account, often up to two days earlier than with traditional banks.

- Bill Payment: Pay your bills directly through the app or online, saving you time and hassle.

How Does Netspend Bank Work?

So, how does all of this magic happen? It’s actually pretty simple. When you sign up for Netspend Bank, you’ll receive a prepaid debit card that’s linked to your account. You can load money onto the card in several ways, including direct deposit, cash reloads at participating retailers, or transfers from another bank account.

Once your card is loaded, you can use it anywhere that accepts Mastercard or Visa. You can also access your account through the Netspend mobile app, where you can check your balance, pay bills, and manage your transactions. It’s like having a personal financial assistant in your pocket.

The Benefits of Using Netspend Bank

Let’s talk about why you should consider making the switch to Netspend Bank. Here are just a few of the benefits:

- No Hidden Fees: Netspend Bank is transparent about its fees, so you’ll never be hit with unexpected charges.

- Financial Control: With Netspend, you have full control over your finances. You decide how much money goes on your card and how you want to spend it.

- Security: Netspend Bank uses top-of-the-line security measures to protect your money and personal information.

- Convenience: From the app to the card, everything about Netspend Bank is designed to make your life easier.

Who Can Benefit from Netspend Bank?

Netspend Bank isn’t just for one specific group of people. Whether you’re a college student, a small business owner, or someone who’s been turned away by traditional banks, Netspend has something to offer. Here are a few examples:

- Unbanked Individuals: If you don’t have a traditional bank account, Netspend Bank provides a way to manage your money without the need for one.

- People with Bad Credit: Netspend doesn’t require a credit check, so even if your credit score isn’t great, you can still enjoy its services.

- Small Business Owners: Netspend offers business accounts that make it easy to manage your company’s finances.

Is Netspend Bank Safe?

One of the biggest concerns people have when it comes to digital banking is security. Let me assure you, Netspend Bank takes security very seriously. Your money is FDIC insured up to $250,000, and the company uses advanced encryption technology to protect your personal information.

In addition, Netspend Bank offers features like text and email alerts to help you monitor your account for suspicious activity. You can also freeze your card temporarily if you lose it or suspect fraud. All of these measures ensure that your money and information are as safe as possible.

Common Misconceptions About Netspend Bank

There are a few misconceptions floating around about Netspend Bank, so let’s clear them up:

- It’s Only for People with Bad Credit: While Netspend Bank is a great option for people with bad credit, it’s also perfect for anyone who wants a simple, hassle-free way to manage their finances.

- It’s Expensive: Netspend Bank is actually quite affordable, especially when you compare it to the fees charged by some traditional banks.

- It’s Not as Secure as Traditional Banks: As we’ve already discussed, Netspend Bank uses advanced security measures to protect your money and personal information.

How Netspend Bank Compares to Traditional Banks

Now that you know what Netspend Bank is and what it offers, how does it stack up against traditional banks? Here’s a quick comparison:

- No Credit Checks: Unlike traditional banks, Netspend doesn’t require a credit check to open an account or get a card.

- No Minimum Balance Requirements: With Netspend, you don’t have to worry about maintaining a minimum balance to avoid fees.

- Lower Fees: Netspend’s fees are generally lower than those of traditional banks, and they’re transparent about what you’ll be charged.

- More Convenient: Netspend’s mobile app and prepaid card make it easy to manage your finances on the go.

Why Choose Netspend Bank Over Other Prepaid Card Providers?

There are plenty of prepaid card providers out there, so why choose Netspend Bank? Here are a few reasons:

- Reputation: Netspend has been around since 1999 and has a proven track record of helping people manage their money.

- Wide Network: Netspend cards are accepted wherever Mastercard or Visa is accepted, giving you more flexibility in how you spend your money.

- Customer Support: Netspend offers excellent customer support, so if you ever have a question or issue, you can get help quickly.

The Future of Netspend Bank

As the world continues to move towards digital banking, Netspend Bank is well-positioned to lead the charge. With its focus on accessibility, convenience, and security, Netspend is poised to become an even bigger player in the financial services industry.

Looking ahead, Netspend Bank is likely to expand its offerings, adding more features and services to help people take control of their finances. Whether it’s through partnerships with other companies or the development of new technology, Netspend Bank is committed to staying at the forefront of the digital banking revolution.

How Netspend Bank is Changing the Game

Netspend Bank isn’t just changing the way people bank; it’s changing the way people think about money. By providing accessible, affordable financial services to everyone, Netspend is helping to level the playing field and empower people to take charge of their financial futures.

It’s not just about offering a prepaid card or a mobile app; it’s about creating a financial ecosystem that works for everyone, regardless of their credit score, income level, or banking history. And that’s something we can all get behind.

Conclusion: Why Netspend Bank is Worth Considering

So, there you have it – everything you need to know about Netspend Bank. From its key features and benefits to its commitment to security and accessibility, Netspend Bank is a game-changer in the world of digital banking.

If you’re tired of dealing with the hassles of traditional banking or you’re looking for a more convenient way to manage your finances, Netspend Bank is definitely worth considering. With its user-friendly app, prepaid cards, and transparent fee structure, Netspend makes it easy to take control of your money.

Now that you’ve got the lowdown on Netspend Bank, what’s next? Why not check it out for yourself? Sign up for an account, get your prepaid card, and see how it can transform the way you manage your finances. And when you’re done, come back here and let us know what you think. We’d love to hear your thoughts!

Table of Contents

- What Exactly is Netspend Bank?

- Why Netspend Bank Matters in Today’s World

- Key Features of Netspend Bank

- How Does Netspend Bank Work?

- The Benefits of Using Netspend Bank

- Who Can Benefit from Netspend Bank?

- Is Netspend Bank Safe?

- Common Misconceptions About Netspend Bank

- How Netspend Bank Compares to Traditional Banks

- Why Choose Netspend Bank Over Other Prepaid Card Providers?

Netspend Login Sign In to Netspend Prepaid Account

Netspend Bank Statement Template Ozoud

Is Netspend a credit card or debit? Leia aqui What type of card is