Unclaimed Assets In Wisconsin Treasury: A Hidden Fortune Awaits

Imagine this—you're sitting on a couch, scrolling through random stuff online when suddenly you stumble upon a shocking discovery. Turns out, there's money with your name on it just chillin' in the Wisconsin Treasury. Sounds crazy, right? Well, it's more common than you'd think. Every year, millions of dollars go unclaimed because people simply don't know they're entitled to them. Today, we're diving deep into the world of Wisconsin Treasury Unclaimed Assets, and trust me, it's a wild ride you won't want to miss.

So, what exactly are we talking about here? Wisconsin Treasury Unclaimed Assets refer to money or property that has been forgotten, lost, or abandoned by its rightful owner. It could be anything from old bank accounts, unpaid wages, tax refunds, utility deposits, or even insurance payouts. And guess what? The state of Wisconsin holds onto these funds until the rightful owner comes forward to claim them. Sounds legit, right?

Now, before you think this is some kind of scam or urban legend, let me tell you—it's 100% real. The Wisconsin Department of Administration (DOA) is the official body responsible for managing these unclaimed assets. They’ve got an entire database dedicated to tracking down owners and reconnecting them with their lost treasures. So, if you've ever wondered whether you might have some unclaimed cash out there, now's the time to find out.

- Jetblue Farefinder Your Ultimate Companion For Seamless Travel Booking

- Notre Dame Is Located Exploring The Heart Of Paris

Why Should You Care About Wisconsin Treasury Unclaimed Assets?

Let’s break it down. Picture this—you've been struggling to make ends meet, paying bills, and trying to save up for that dream vacation or home renovation. Meanwhile, there’s a chunk of cash sitting in the Wisconsin Treasury waiting for you to claim it. Doesn’t that sound like a plot twist straight out of a movie? The reality is, many people have no idea they’re owed money, and it’s often because they don’t even know where to look.

Wisconsin Treasury Unclaimed Assets aren’t just a random thing either. This is a serious issue that affects thousands of residents every year. In fact, as of the latest data, the state holds over $600 million in unclaimed funds. Yeah, you read that right—six hundred million dollars. That’s enough to buy a small island, or at least pay off a few student loans.

But here’s the kicker—not everyone knows about it. Most people assume that if they had unclaimed money, someone would’ve told them by now. Spoiler alert: that’s not how it works. The onus is on YOU to take action and search for your potential windfall. So, are you ready to uncover your hidden treasure? Let’s get started.

How Do Assets Become Unclaimed?

Now, you might be wondering how all this money ends up in the Wisconsin Treasury in the first place. Well, it’s a pretty straightforward process. When someone loses track of their financial accounts or property, the banks, companies, or government agencies holding those assets are required by law to turn them over to the state after a certain period of time. This period is called the "dormancy period," and it varies depending on the type of asset.

Here’s a quick breakdown of how it happens:

- Bank Accounts: If you haven’t touched your account in five years, the bank will send the funds to the state.

- Pensions: Forgotten retirement accounts often end up in the unclaimed assets database.

- Stocks and Bonds: Unclaimed dividends or matured bonds are also sent to the treasury.

- Tax Refunds: If you failed to cash your tax refund check, the state will hold onto it.

- Insurance Policies: Life insurance payouts can go unclaimed if beneficiaries aren’t aware of their rights.

And that’s just the tip of the iceberg. There are countless ways assets can slip through the cracks, and once they do, they become part of the Wisconsin Treasury Unclaimed Assets program.

Who Can Claim Unclaimed Assets?

Good news—anyone can claim unclaimed assets as long as they can prove ownership. Whether it’s you, a family member, or even a deceased relative, the process is open to everyone. But here’s the thing—you need to provide solid evidence to back up your claim. This could include documents like bank statements, tax records, or legal papers proving your connection to the asset.

In some cases, heirs or beneficiaries can also claim assets left behind by deceased loved ones. For instance, if your grandpa had an old savings account he never touched, and he passed away without telling anyone about it, you might be entitled to that money. The key is to gather all the necessary paperwork and submit it to the Wisconsin DOA for verification.

Steps to Claim Your Unclaimed Assets

Claiming unclaimed assets isn’t rocket science, but it does require a bit of legwork. Here’s a step-by-step guide to help you navigate the process:

- Search the Database: Head over to the official Wisconsin Treasury Unclaimed Assets website and enter your name or any other relevant details. You can search by last name, city, or even business name.

- Verify Ownership: Once you find a match, gather all the necessary documents to prove your identity and ownership of the asset.

- Submit Your Claim: Complete the claim form and attach all required paperwork. Make sure everything is accurate and up-to-date to avoid delays.

- Wait for Approval: Processing times can vary, but most claims are resolved within a few weeks. Keep an eye on your email or mail for updates.

And just like that, you could be on your way to reclaiming your lost fortune. Easy peasy, right?

Common Myths About Unclaimed Assets

Before we move on, let’s bust some common myths about Wisconsin Treasury Unclaimed Assets. There’s a lot of misinformation floating around, and it’s important to separate fact from fiction. Here are a few of the most common ones:

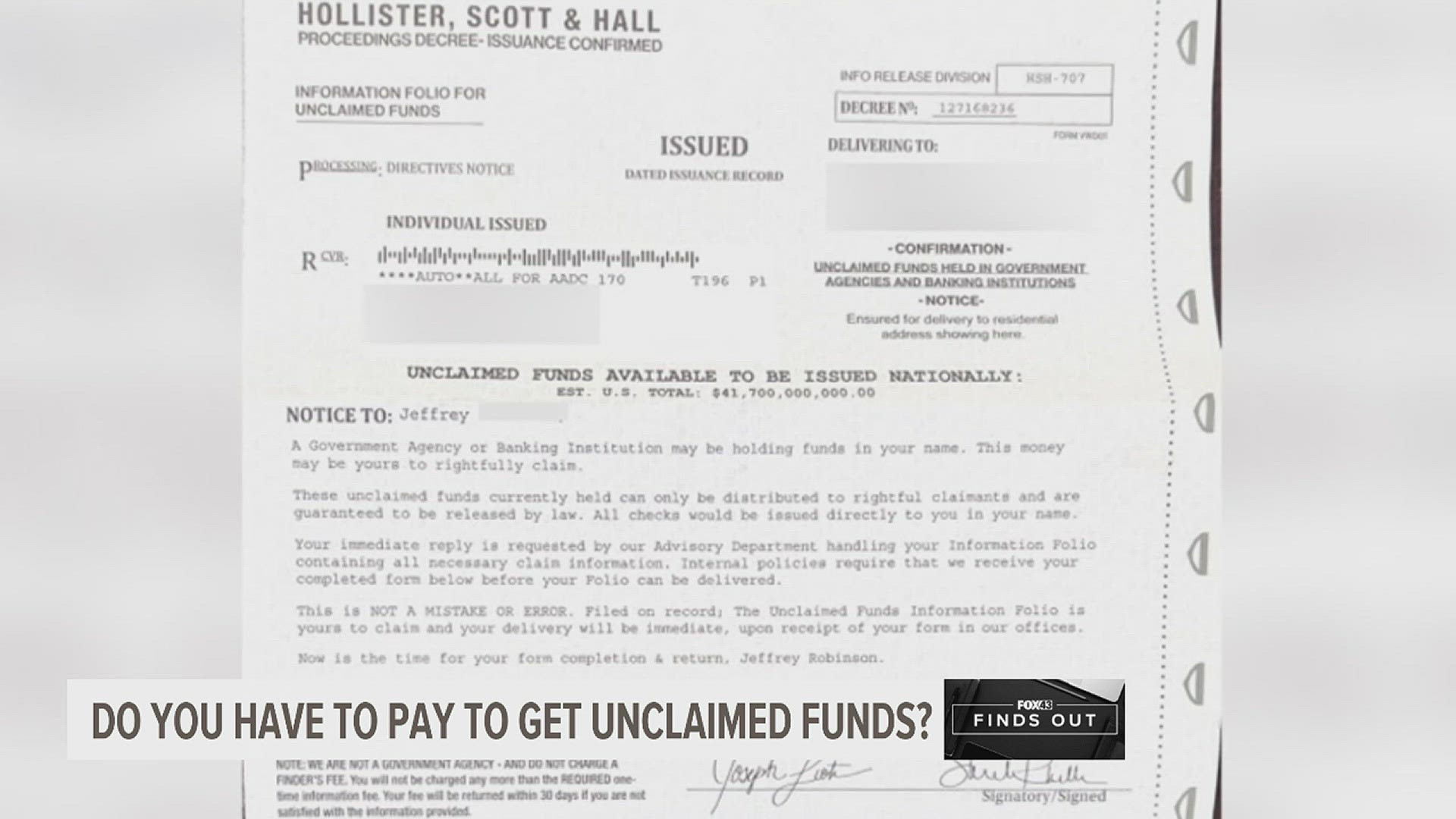

- Myth #1: You have to pay a fee to claim unclaimed assets. False. The process is completely free, and any company charging you to help with your claim is likely a scam.

- Myth #2: Only rich people have unclaimed assets. False again. Anyone can have unclaimed money, regardless of their financial status.

- Myth #3: You need to live in Wisconsin to claim assets. Not true. As long as the asset originated in Wisconsin, you’re eligible to claim it, even if you live out of state.

So, there you have it. Don’t fall for these myths—they’re just distractions from the real prize waiting for you.

Wisconsin Treasury Unclaimed Assets Statistics

Let’s talk numbers for a sec. As of 2023, the Wisconsin Treasury holds over $600 million in unclaimed assets, with an average claim amount of around $1,500. That’s a lot of dough just sitting there, waiting for its rightful owners. Here’s a breakdown of the most common types of unclaimed assets:

- Bank Accounts: 40%

- Tax Refunds: 25%

- Pensions: 15%

- Insurance Policies: 10%

- Other Assets: 10%

These stats paint a clear picture—there’s a good chance you or someone you know has unclaimed money out there. All you need to do is take the first step and start searching.

How to Search for Unclaimed Assets

Searching for unclaimed assets is easier than you think. The Wisconsin DOA provides a user-friendly online database where you can search for potential matches. Here’s how to do it:

- Visit the Official Website: Head over to the Wisconsin Treasury Unclaimed Assets portal and click on the search bar.

- Enter Your Details: Type in your name, city, or any other relevant information. You can also search by business name if you suspect a company owes you money.

- Review the Results: If you find a match, take note of the asset details and gather all the necessary documents to support your claim.

It’s that simple. And the best part? The search is completely free, so there’s no risk involved. What are you waiting for? Go check it out!

Additional Resources for Searching

While the Wisconsin DOA database is the most reliable source for finding unclaimed assets, there are other resources you can use to expand your search:

- MissingMoney.com: A national database that allows you to search for unclaimed assets across multiple states.

- USA.gov: The official government website for unclaimed assets and other financial resources.

- Local County Offices: Sometimes, unclaimed assets are held at the county level, so it’s worth checking with your local authorities.

By using these resources, you can cast a wider net and increase your chances of finding hidden treasures.

Legal Considerations for Claiming Unclaimed Assets

Now, let’s talk about the legal side of things. While claiming unclaimed assets is generally straightforward, there are a few legal considerations to keep in mind:

- Time Limit: There’s no statute of limitations for claiming unclaimed assets in Wisconsin, so you can file a claim at any time.

- Heirship Claims: If you’re claiming assets on behalf of a deceased relative, you’ll need to provide proof of heirship, such as a death certificate or will.

- Scams and Fraud: Be wary of companies or individuals claiming they can help you recover unclaimed assets for a fee. Always use official channels to avoid falling victim to scams.

By staying informed and following the proper procedures, you can ensure a smooth and hassle-free claiming process.

Conclusion: Time to Claim Your Hidden Fortune

And there you have it—the ultimate guide to Wisconsin Treasury Unclaimed Assets. Whether you’re a lifelong resident or just passing through, there’s a good chance you’ve got some unclaimed money out there waiting for you. Don’t let it slip through your fingers—take action today and start your search.

Remember, the process is free, easy, and completely worth it. Who knows? You might just uncover a hidden fortune that changes your life forever. So, what are you waiting for? Head over to the Wisconsin Treasury Unclaimed Assets website and see if you’ve got any surprises waiting for you.

And if you found this article helpful, don’t forget to share it with your friends and family. You never know who else might have unclaimed assets waiting for them. Happy hunting!

Table of Contents

- Why Should You Care About Wisconsin Treasury Unclaimed Assets?

- How Do Assets Become Unclaimed?

- Who Can Claim Unclaimed Assets?

- Steps to Claim Your Unclaimed Assets

- Common Myths About Unclaimed Assets

- Wisconsin Treasury Unclaimed Assets Statistics

- How to Search for Unclaimed Assets

- Additional Resources for Searching

- Legal Considerations for Claiming Unclaimed Assets

- Conclusion: Time to Claim Your Hidden Fortune

- 49ers Qb All Time A Deep Dive Into The Greatest Quarterbacks In 49ers History

- George Clooney Race The Untold Story Of Passion Speed And Philanthropy

John Leiber, Aaron Richardson on their 2022 run for state treasurer of

I got this letter about unclaimed funds. Is it a scam?

How to check if you have unclaimed property in Wisconsin